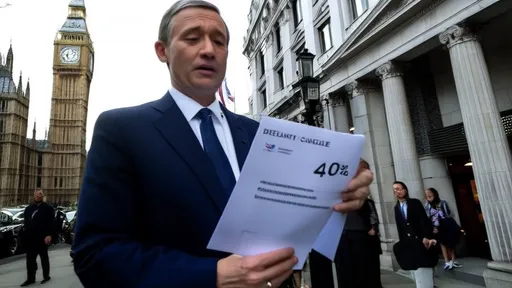

The Bank of England has taken decisive action to address growing economic headwinds, announcing a 25 basis point reduction in its benchmark interest rate to 4.0%. This move marks the first rate cut by the UK central bank in over three years and comes amid mounting evidence of an economic slowdown across multiple sectors.

Monetary Policy Committee members voted 7-2 in favor of the rate reduction during their latest meeting, with the dissenting voices preferring to maintain rates at 4.25%. The decision reflects growing concerns about weakening consumer spending, stagnant business investment, and deteriorating global economic conditions that have begun weighing heavily on Britain's economic prospects.

Governor Andrew Bailey emphasized that while inflation remains above the Bank's 2% target at 2.8%, the disinflationary trend has become sufficiently established to allow for modest monetary easing. "We're seeing clear evidence that price pressures are moderating across the economy," Bailey stated during the press conference following the announcement. "At the same time, leading indicators suggest we cannot ignore the risks of undershooting our inflation target in the medium term if growth continues to weaken."

The rate cut comes against a backdrop of disappointing economic data. Recent figures showed the UK economy contracted by 0.3% in the final quarter of 2023, while business surveys point to continued weakness in early 2024. Manufacturing output has declined for five consecutive months, and the services sector - which accounts for about 80% of UK economic activity - has shown signs of losing momentum.

Market reaction was mixed following the announcement, with the FTSE 100 initially rising before giving up gains to close 0.4% lower. The pound sterling fell 0.8% against the US dollar to $1.2450, its lowest level in six weeks. Government bond yields dropped across the curve, with the 10-year gilt yield falling 12 basis points to 3.62%.

Analysts interpreted the Bank's accompanying statement as leaving the door open for further easing. "The Committee will continue to monitor closely incoming data and adjust Bank Rate as appropriate to return inflation sustainably to the 2% target," the statement read. Many economists now anticipate another 25 basis point cut could come as soon as the May meeting if economic conditions don't improve.

The decision places the UK at the forefront of major Western economies in beginning to unwind the aggressive tightening cycles that characterized 2022 and much of 2023. Both the US Federal Reserve and European Central Bank have signaled they may begin cutting rates later this year but have so far maintained their current policy stances.

Business groups largely welcomed the move. "This rate cut provides some much-needed relief to firms struggling with high borrowing costs," said Rain Newton-Smith, Director General of the Confederation of British Industry. "With many companies facing squeezed margins and weaker demand, today's decision should help support investment and protect jobs."

However, some economists expressed concerns that premature easing could risk reigniting inflationary pressures. "Core inflation remains stubbornly elevated at 4.2%, and wage growth at 6.2% is still far too hot," warned Ruth Gregory, Deputy Chief UK Economist at Capital Economics. "The Bank may find itself having to reverse course later this year if price pressures prove more persistent than anticipated."

The housing market represents one sector likely to benefit directly from lower rates. Mortgage lenders immediately began repricing their products, with several major banks announcing reductions in their standard variable rates. "For homeowners coming off fixed-rate deals this year, today's decision could mean the difference between manageable payments and real financial strain," noted housing market analyst Henry Pryor.

Consumer groups cautioned that while lower rates may help some borrowers, many households continue to face significant financial pressures. "The reality is that millions are still grappling with much higher mortgage payments than they were two years ago," said Rocio Concha, Director of Policy and Advocacy at Which?. "And with energy bills and food prices remaining elevated, the cost-of-living crisis is far from over for many families."

The Bank's latest forecasts suggest inflation will fall below target to around 1.5% by late 2025, while GDP growth is projected to remain below 1% through much of this year before picking up modestly in 2025. These projections assume one further 25 basis point rate cut later in 2024, followed by a gradual normalization of policy as economic conditions improve.

Political implications of the decision may prove significant, coming as the Conservative government prepares for a challenging general election expected later this year. Chancellor Jeremy Hunt welcomed the move, stating it showed the government's economic plan was working. Opposition Labour Party leaders countered that the rate cut merely confirmed the economy was weakening under Conservative stewardship.

International factors played a key role in the Bank's decision-making process. Slowing growth in China and Europe, combined with geopolitical tensions in the Middle East and Ukraine, have created substantial uncertainty about the global economic outlook. "The UK cannot insulate itself from these external headwinds," noted Deputy Governor Ben Broadbent during the press conference. "Our job is to respond appropriately to how these factors affect domestic economic conditions."

Bank officials stressed that monetary policy would remain restrictive despite the cut, with the 4.0% rate still well above the near-zero levels that prevailed for much of the past decade. "We are not embarking on a prolonged easing cycle," Governor Bailey emphasized. "This is a modest adjustment in response to changing economic conditions, not a fundamental shift in our policy stance."

The decision comes as other central banks grapple with similar policy dilemmas. While the Swiss National Bank has already begun cutting rates, the Federal Reserve has signaled it wants to see more evidence of cooling inflation before reducing borrowing costs in the United States. This divergence in policy paths could lead to further volatility in currency markets in coming months.

Looking ahead, economists will scrutinize upcoming data releases for clues about whether additional easing might be warranted. Key indicators to watch include wage growth figures, services inflation, and business investment trends. The Bank's next Monetary Policy Report in May will provide updated forecasts that could shape the timing of future rate decisions.

For now, the rate cut represents a calculated gamble by policymakers - an attempt to provide some stimulus to a flagging economy without jeopardizing hard-won progress against inflation. The coming months will reveal whether this balancing act has been successful or if more aggressive action - in either direction - may become necessary.

As businesses and households adjust to the new rate environment, the broader economic picture remains uncertain. While lower borrowing costs may help cushion the slowdown, structural challenges including weak productivity growth and labor market shortages continue to constrain Britain's economic potential. The Bank's move today acknowledges these realities while attempting to navigate what Governor Bailey called "one of the most challenging policy environments in recent memory."

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025