The global manufacturing sector is grappling with an unprecedented cost crisis as copper prices have skyrocketed by 50% over the past year. This dramatic surge in the red metal's value is sending shockwaves through industries ranging from construction and electronics to renewable energy and automotive production.

Copper's relentless price rally shows no signs of abating, with the commodity trading at record highs not seen since the supercycle of the early 2010s. The London Metal Exchange benchmark recently breached the $10,000 per metric ton barrier, a psychological threshold that has manufacturers worldwide scrambling to adjust their cost structures.

What makes this price explosion particularly concerning is copper's ubiquitous role in modern manufacturing. Unlike niche commodities that affect specific sectors, copper serves as the literal wiring of the global economy. From electrical components to plumbing systems, and from electric vehicles to data centers, virtually every major industry depends on this conductive metal.

The roots of the current price surge are complex and multifaceted. On the supply side, major copper-producing nations like Chile and Peru have faced operational challenges ranging from labor strikes to regulatory hurdles. Meanwhile, demand continues to grow exponentially, particularly from the green energy transition which requires massive amounts of copper for wind turbines, solar panels, and EV infrastructure.

Manufacturers are feeling the pinch across their entire supply chains. "We're seeing cost increases that simply can't be absorbed through efficiency gains alone," said the CFO of a major European appliance manufacturer who asked not to be named. "The math is brutal - when your single largest raw material input jumps 50% in twelve months, something has to give."

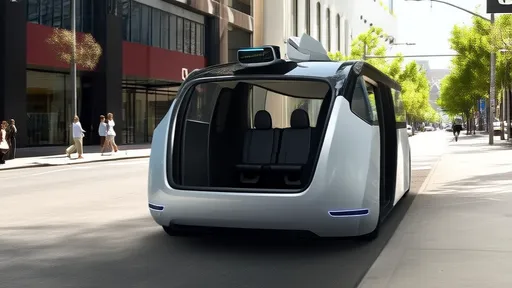

The automotive sector, already struggling with semiconductor shortages, now faces this additional cost burden. An average internal combustion engine vehicle contains about 20 kilograms of copper, while electric vehicles require nearly four times that amount. As automakers accelerate their EV transitions to meet regulatory targets, their copper exposure grows proportionally.

Construction companies are similarly vulnerable, with copper being essential for electrical wiring, plumbing, and HVAC systems in both residential and commercial buildings. Several major construction firms have reported having to renegotiate contracts mid-project or implement copper substitution strategies where possible.

Electronics manufacturers face perhaps the most immediate pressure, as copper is fundamental to printed circuit boards, wiring, and electrical components. Many consumer electronics companies are reportedly considering price increases for the first time in years, potentially passing these costs along to end consumers.

The renewable energy sector's growth ambitions may face headwinds from copper's price trajectory. A single wind turbine contains between 3 to 5 tons of copper, while solar photovoltaic systems require about 5.5 tons per megawatt of generation capacity. These material costs could slow the pace of renewable adoption just as governments worldwide are pushing for accelerated transitions.

Geopolitical factors are exacerbating the supply-demand imbalance. Tensions between major Western economies and copper-rich nations like Russia and the Democratic Republic of Congo have introduced new uncertainties into global supply chains. Meanwhile, China's strategic stockpiling of copper reserves continues to remove significant quantities from the available market supply.

Financial speculation has also played a role in copper's price appreciation. As inflation fears grow, institutional investors have increasingly turned to commodities like copper as a hedge against currency devaluation. This financial demand creates additional upward pressure beyond the fundamental industrial usage.

Manufacturers are responding with a mix of strategies, none of them ideal. Some are attempting to lock in long-term supply contracts at current prices, betting that the market has further to run. Others are exploring alternative materials, though few can match copper's unique combination of conductivity, durability, and malleability.

The recycling market for copper has become fiercely competitive as companies seek secondary sources. "We're seeing scrap copper prices rise nearly in lockstep with virgin material," noted a metals trader in New York. "The circular economy is heating up out of necessity rather than environmental ideology."

Laboratories and material science startups report surging interest in copper alternatives and efficiency technologies. From conductive polymers to aluminum substitution in certain applications, researchers are working overtime to develop solutions. However, most alternatives face significant technical or scale limitations that prevent widespread adoption in the near term.

Central banks are monitoring the situation closely, as copper's price surge contributes meaningfully to broader inflationary pressures. Unlike more volatile commodities, copper's fundamental importance to industrial production means its price increases have cascading effects throughout the economy.

The duration of this copper crunch remains uncertain. While new mines are in development, they face lengthy lead times and environmental opposition. Short-term relief would likely require either a significant economic slowdown reducing demand or a geopolitical breakthrough improving supply access - neither scenario appears imminent.

For manufacturers, the copper crisis represents yet another supply chain challenge in an era already marked by disruptions. Those who can't pass costs along to customers face margin compression, while others risk pricing themselves out of markets. The coming quarters will test the resilience of global manufacturing as it adapts to this new reality of persistently expensive copper.

Industry analysts suggest we may be witnessing a structural repricing of copper rather than a temporary spike. The metal's central role in both traditional manufacturing and the clean energy transition could support elevated prices for years to come. Manufacturers who haven't already developed comprehensive copper strategies may find themselves at a severe competitive disadvantage.

As the situation evolves, one thing appears certain: the era of cheap and abundant copper is over. The manufacturing world must now adapt to operating in an environment where this fundamental industrial metal commands premium pricing, with all the cost pressures and innovation imperatives that entails.

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025